Working Alone When Deciding As A Team

What do Monday partner meetings have in common with pot roast?

First, a quick reminder: If you want to join us for Automatter fireside chats — where we’ll geek out on automation, process design, and investing with a few of our closest friends, click the big honkin’ button below and let us know!

Now back to the show.

(This is the second in a series on the Find-Decide-Win parts of the VC process. Part 1 is here.)

Some of you probably know the classic “pot roast” story. For those who don’t, it goes something like this:

A child asks why their family’s recipe for pot roast calls for cutting the ends off before putting it in the oven. Their parents don’t know. Their grandparents don’t know. They did it because it was in the recipe and they assumed it made a better roast. But then they ask great-grandma and she explains that they cut the ends off because their old oven was too small.

What does this have to do with automation? Simple inertia and status quo bias can lead to ossified, overly-complex processes and we must constantly reexamine whether they are still serving their intended purposes. For example, Monday partner meetings at some VC firms have the hallmarks of religious ceremonies. But is the meeting format truly additive or is it a process detail? And which rote steps or process details are actually additive steps in disguise?

Let’s carry that attitude forward as we apply Halle’s “data-at-your-fingertips” approach -- specifically on data management and “right-on-time” data -- to the step I believe is the most generative and cognitively taxing: Decide. As we dive deeper into it, we’ll see that the core actions remain resistant to automation, but relieving the cognitive burden of rote communication and automating team updates means you can stay in flow for longer and dedicate more time to investing in and helping portfolio companies.

Don’t make your partners redo your due diligence

One of the most common misconceptions about venture capital is that it’s a team sport. And while resources and networks are frequently shared, most of the day-to-day work is self-driven and solitary. It’s research, reflection, and writing. It’s scrutinizing metrics and investor updates. But when it’s time to make investment decisions, you need everyone to be operating from a clear thesis and the same set of facts.

This is where data management comes into play. Being consistent about what data you should gather and where it lives is a prerequisite for automation. Whether that data lives in Airtable, a spreadsheet, Roam, Notion -- hurry up, Notion API! -- there should never be any question about where you go to find information that has already been gathered. With one central repository, you’ll retrace fewer steps and spend less time explaining the context behind your decisions.

Let’s put this into practice. Take a look at our hypothetical Automatter CRM. It has structured fields for key information like headcount and raise target. “Company description” and “Team notes” are catch-all sections, but we could customize this further by adding fields that you know you’ll want to see in a more structured format. For example, if we always ask about MRR and how much revenue is in the sales pipeline, we can add them as their own fields.

We can also add automation to highlight key events like pitch meetings. To enable that, I added a meeting report form and got creative with Zapier. Add a few key details and paste your notes in there, and voila:

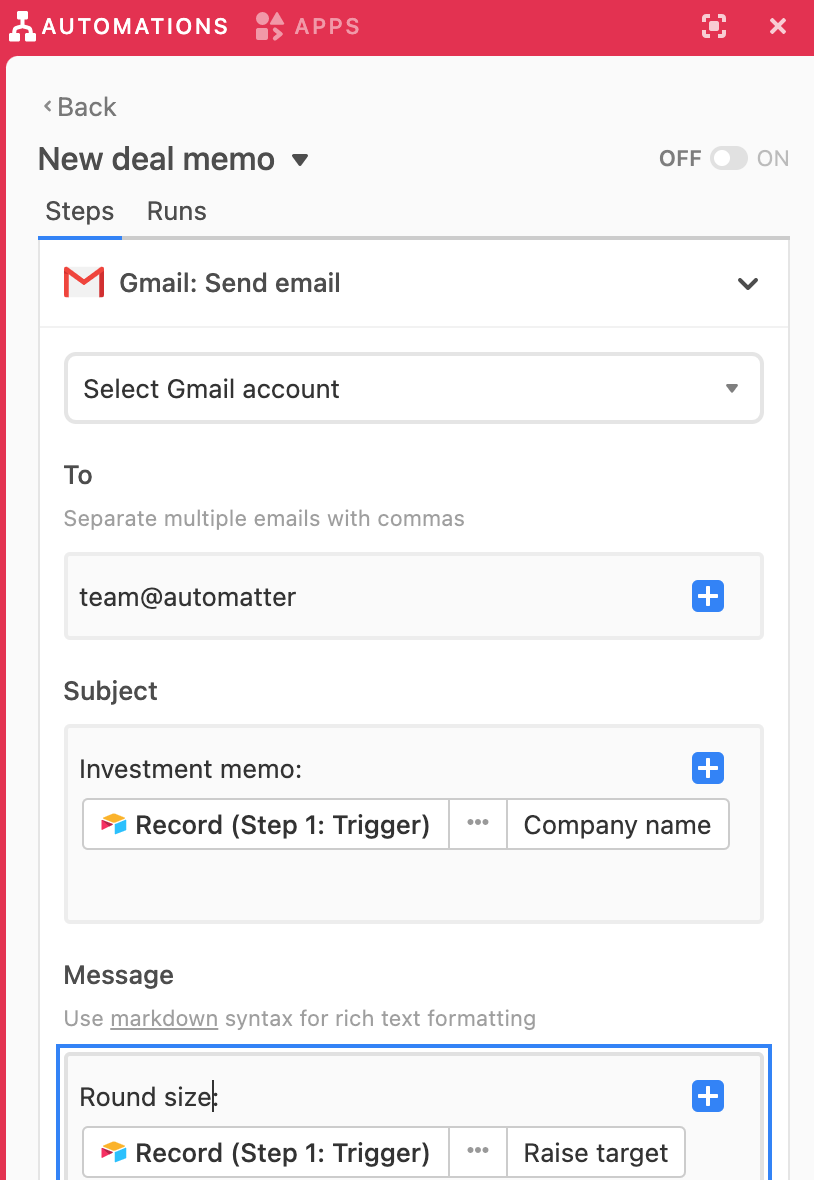

Meanwhile, with thoughtful data management, each record is an investment memo waiting to happen. Literally. You can programmatically generate the artifact of an investment memo when you’re ready. You can create a new document from text or a template in Zapier or just send it as an email directly out of Airtable.

This is good. But let’s go one step further. And let’s return to the topic of Monday partner meetings and data-at-your-fingertips. And pot roast.

Those high-stakes Monday meetings traditionally pull in every decision maker to take final pitches and make decisions on a handful of deals in progress. Due to the nature of the meetings, investors who are unfamiliar with the company are expected to brief themselves in advance. They are heavyweight affairs that are not conducive to the speed of modern seed investing. So it might be an easy decision for an emerging fund to cut this ritual entirely and move to primarily asynchronous decision making.

But consider what else you’re cutting: Informal networking and information exchange. Temperature checks on deals other partners are excited about but aren’t ready to invest in yet. Full partner meetings were an inefficient way to do this, but firms got this part for free because they were bundled with pitch meetings.

Cutting those meetings wholesale is like leaving the ends on the pot roast but not adjusting the cook time. Working solo but making decisions as a team requires a culture of awareness and preparation. Automation and process design is how you make the necessary data easily available “right-on-time,” minimizing the cognitive burden of communication and rote process.

That could be in the form of a regularly-scheduled email digest of in-progress deals, a weekly @everyone nudge in Slack with a link to the in-progress deals view in Airtable, or even just the honor system. Frankly, for most small firms and emerging managers, the honor system will be enough.

Sometimes the best process is no process at all.