Two steps forward, one step back

Or why you don't start process design at the beginning

(This is the first in a series on the Find-Decide-Win parts of the VC process.)

One of the primary themes we're going to explore on Automatter is how well-intentioned, ambitious processes can be derailed and their quality degraded at every step by cognitive burdens, miscommunications, and information loss. With thoughtful process design and automation, we can mitigate all of these issues. Let's start by jumping right into the first step of the venture capital process we talked about in our first post: Find.

What do we do when we find a company we want to explore further? Or when that company finds us? How do we move that company to the Decide step with minimal friction and ensure we have the key data at our fingertips when we (and members of our team) are ready for diligence?

Multiple paths, one destination

Let's put ourselves in the shoes of the associate or scout who has just learned about a company they want to pursue. Where did they find this company? There are almost as many sourcing strategies as there are investors, but they might have...

Been contacted through an online form

Received an inbound email (warm or cold)

Met the founder at an event and connected by email afterward

Come across the company on Twitter or Product Hunt

Each method offers a different mix of data points, structured and unstructured communications, and cognitive activities. But this associate still has to fulfill the functional end of the Find step: Get as much data as possible into a digestible format. That format could be a dedicated CRM, Notion doc, Airtable base, or even a bog-standard spreadsheet (but maybe you should skip the spreadsheet for this one). So we have to answer a seemingly simple question: What data will help us Decide?

And so we come to our first Automatter Axiom (™,©, patent pending, all glory to the hypnotoad): No step in a process exists in a vacuum. Every step in every process is impacted by its adjacent steps, and decisions made at any point in designing a process have ripple effects and may prompt changes elsewhere.

In this case, we need to know the destination before we can properly design processes to get us there. And that brings us back to that question: What will help us Decide?

[Sound of Tires Screeching]

Let's avoid a detour into the Land of 1,000 VC Thinkpieces and the Commonwealth of MarketSize-upon-ARR. Suffice it to say that relevant metrics vary by industry, business model, size, and stage. Remember: This is a blog about processes and automation and VC is just our vehicle of choice for now.

The Decide part of the VC process is a lot of gumshoe work. It's interviews and reference checks, market research, and scenario modeling (if you're into that sort of thing). For an investor, it's arguably the most generative, cognitively-taxing part of the whole process. If you're not a solo capitalist (another Nikhil hat tip), this is going to involve teamwork, and that means this step is as much about effective delegation and transparent communication as it is about automation.

How do we support that? We narrow the data we need to collect up front to reduce information overload, then build scaffolding to reduce the natural cognitive burdens and information loss inherent in this creative process. Thinking about it from a higher level, we want to cut down how much thinking the team has to do about the process itself: How they learn about new activities, where information lives, and where communication happens.

Now let's have a little fun. Let's take a look at an easy, structured example of an inbound deal and see if we can get from one investor deciding to pursue a deal to everyone knowing what the deal is in three clicks or fewer. Like Ted Lasso rounding up the Diamond Dogs, let's make it easy to call in the people who care.

Enter our (hypothetical) firm, Automatter Ventures

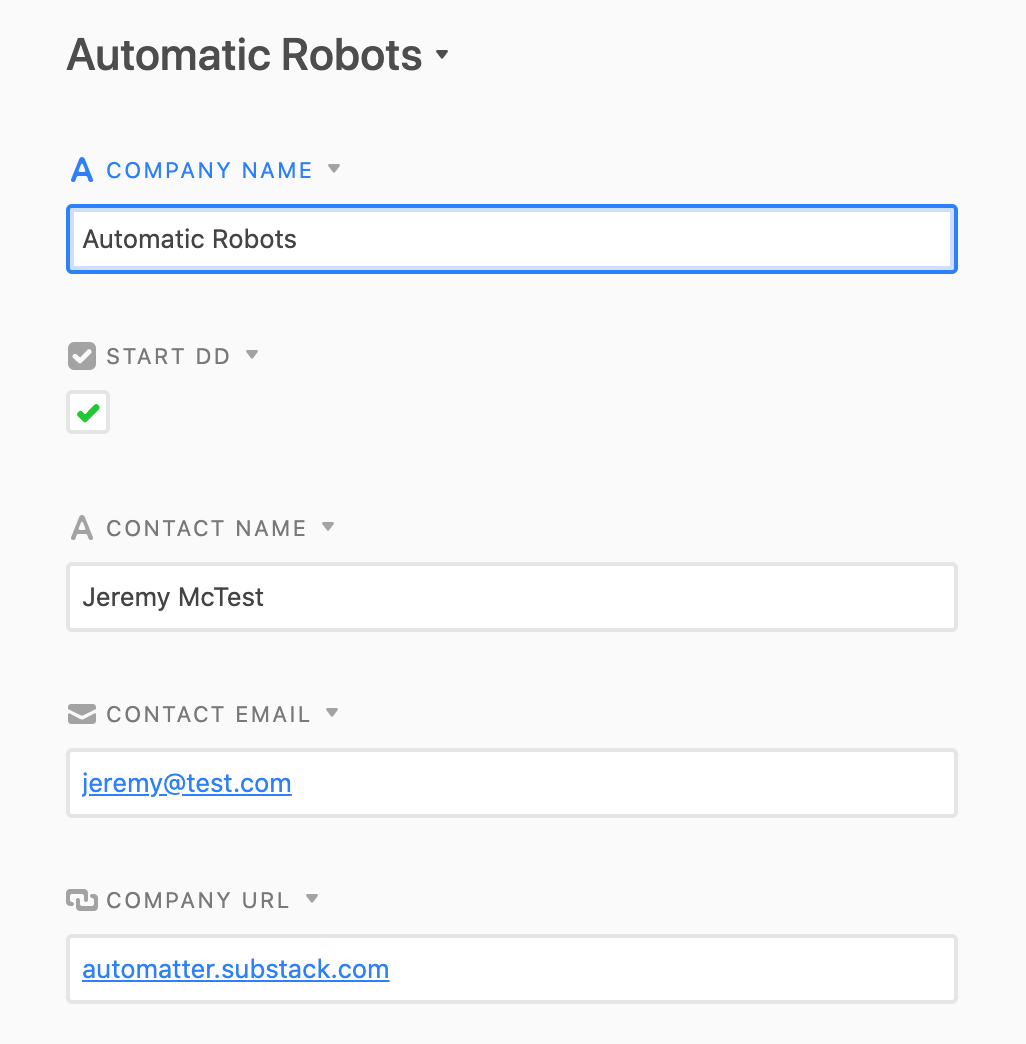

I started by creating an Airtable base — you can actually view it and duplicate it from this link. I added a few tables that I may build on for later posts, but right now we just need to focus on the Deals table. I’ve also added a “Pursuing” view that will come in handy later… and a form view. And that form is where we’ll start this journey. What do you notice about it?

Here's what I want to highlight:

It's short. Information overload goes both ways here: Very few people are willing to spend more than a couple of minutes on a survey and since founders will be doing us a favor structuring their pitch for a form we created, it's better for everyone if we make it easy.

It's responsive. I'm specifically referring to "How do you want to share your pitch?" We can safely assume most founders will have a pitch and that most of them will be delivered as either a file or a link, but we don't know which one. So we enable either option. Speaking of this...

It allows unstructured data to be stored in a predictable way. We can systematically move and manipulate the data we receive in the other fields, but we can't automatically pull all of the key data out of a pitch deck (as of this writing, anyway). This may seem obvious, but it reduces a cognitive burden down the line: Looking for the deck and sharing it with the team. We know we’re going to do this anyway, so we may as well agree in advance where the deck is going to be and then make it easy to reach it. We will come back to this.

There's a freeform field at the end. Eventually, edge cases will pop up — possibly from founders whose companies don't fit into any of the set categories in the preceding question — and by offering this release valve, there's at least a chance we'll get visibility into them and eventually amend the process to cover them.

Now lightning can strike. Let's get into Zapier. Here at Automatter Ventures, we spend a lot of time in Slack, so let's make sure this new deal is on our radar.

That Zap produces this in Slack:

(Yes, it's a gag image instead of a deck, but I give great pitch deck feedback too.)

Click 1: The investor clicks the pitch deck and previews it directly in Slack. She scrolls through, likes what she sees, and decides to elevate it to the team.

Click 2: She follows the instructions and clicks the link to go directly to the record in our Airtable, where...

Click 3: She clicks "Start DD."

Behind the scenes, the record gets filtered into our Pursuing table view.

And that triggers a second Zap.

And the results:

And over in the new deals feed:

Voila! From the investor's perspective, all she did was evaluate a pitch inside a communications channel where she already spends a lot of time... and then check a box. All of the other little pieces that entail moving from Find to Decide — the dozen minor actions and decisions, each one an opportunity for concentration-destroying context switching — have been sidelined and the primary cognitive work has been brought forward, with the relevant information right at her fingertips.

It’s good to start small

Obviously, some caveats apply and this is one of the easiest, simplest versions of this workflow. We'll save the edge cases (and creative solutions) for future dispatches. For now, think about the process in terms of your own preferences for communicating and sharing information. For example:

How can I adjust this process if our team spends more time in email than in Slack?

Should I ask for more data up front? Should I ask for metrics related to revenue, user growth, and engagement? Does it depend on the business model? Does it depend on the stage I'm investing in? How can I make that data capture process easy and responsive?

What if I’m sourcing deals primarily through research and outreach? How would I make it easy to add a new company to my CRM? (Here’s one creative solution: Yohei Nakajima at Scrum Ventures uses a web clipper and then pings the Crunchbase API with a bit of Javascript. You can do it all in Zapier.)

How would we extend this process into a dedicated project management tool like Trello or Asana (or even a Kanban view directly in Airtable)? What has to be true about your team to make that part of your workflow?

Thanks for reading! If you liked this, find me on Twitter and share Automatter with the people in your life who dig this topic. Everyone knows someone like that. You know who I’m talking about.