Automating Investor Relations

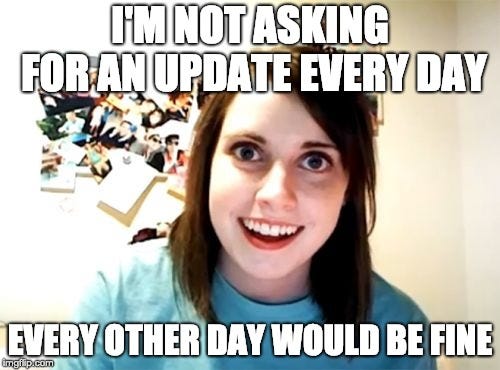

What to do when an LP becomes a stage five clinger...

2020, the year the entire world was shut down by a global pandemic, was the largest ever fundraising year for VCs with over $70 billion raised. While much of this growth can be attributed to mega-funds raised by legacy firms, it was also the first year that the number of emerging funds raised approached the number of established funds (159 vs 162, respectively). This is exciting — new fund managers means more money for founders and a greater diversity of backgrounds in what has too long been a homogenous industry.

But let’s dive a little deeper. In 2020, 75% of the total dollar value raised by VCs went to established funds, meaning that legacy VCs are still largely deciding who gets funded. That percentage is only expected to increase in 2021. Despite data that shows that smaller funds outperform large ones, emerging fund managers (defined as those raising their first or second fund) are still struggling to fundraise. According to a Twitter poll of 251 emerging managers, 50% report having spoken to over 100 LPs in order to raise their fund. 30% spoke to over 250. Hustle Fund's Elizabeth Yin reports having spoken to over 700 LPs to raise their first fund ($11.5M) and Rarebreed Ventures' Mac Conwell spoke to over 1000, sometimes taking up to 20 meetings in a single day.

There are a number of reasons why first or second time fund managers disproportionately struggle to raise their funds. Of course, there's the fact that VC is an insider's club built upon exclusionary practices. As we've previously discussed, these problems won't be solved through process or automation... but emerging managers can use these tools to create more leverage.

Oper8r, which is often referred to as "the YC for Emerging Managers," has done a great job unpacking the LP perspective towards emerging managers. LPs are skittish towards new VCs because they lack track records, are perceived to be riskier, and require increased resources dedicated to search and diligence.

VC is still a relationship business, and fundraising requires trust and credibility. You can't hack the process of building authentic relationships. But, while trust and authenticity can't be built through software, automation and process design can significantly ease the burden of maintaining and nurturing those relationships.

LPs' skittishness towards emerging managers can be remedied with good data strategy along with intentional processes and habits. Smart managers can and will automate and systematize significant elements of investor relations, specifically those around data sharing, in order to free up more time to do the heavy lifting of building valuable, authentic relationships.

Here’s what we’d suggest:

For the love of god, get your CRM into shape already. Create habits around data entry and management so that you don't have to think twice when you need to extract information about a new investment (or a pass) for an investor update.

Automatter suggests... you already know.

Use portfolio management software that plugs into your CRM and other complementary data sources. Decide how much data you (and your portfolio companies) are comfortable sharing LPs and grant them access. Set expectations with LPs that you won't be indulging ad hoc data requests, since they’ll have access to everything they need via the platform.

Automatter suggests... Visible VC. Visible’s platform allows VCs to aggregate portfolio data they care about most, set up key metric alerts, and share that data in aesthetic dashboards and charts.

Systematize your investor updates. This means sticking to a consistent cadence and format. Consistency will help prevent LP anxiety when they haven't heard from you in a month, and creating a standard format will help you plug and play data from your CRM or portfolio management tool when it comes time to write an update.

Automatter suggests... this piece on writing investor updates by Ryan Hoover of Weekend Fund. As we learned during our fireside chat with Weekend Fund's Vedika Jain, the firm uses an Airtable CRM to store data in a structured format and create more leverage for their two-person team. They use investor updates as an opportunity to put LPs to work for their portfolio companies. This means giving LPs enough data on investments that they can proactively offer assistance in their areas of expertise without Ryan and Vedika having to make one-off asks.

Use a build in public approach to display your credibility and track record. If you're fundraising, this is only possible if you have a 506(c) fund structure. If you've closed your first fund, consider engaging publicly with your fund I LPs. Seeing the conviction that other LPs have built an emerging fund manager can help ease skittishness.

Automatter suggests... our piece on how to get more functionality out of Twitter. Twitter typically isn’t the first software that comes to mind when you think about automation or workflow tools. In this article, I suggest a number of ways to increase the value of Twitter as a communication, fundraising, and deal flow tool.

Crowd-sourced suggestions:

Oper8r suggests… having a Schedule of Investments at the ready to share with potential LPs.

Samir Kaji suggests... checking out his database of LPs who are investing in underrepresented fund managers.

Minal Hasan suggests… sending LP updates to potential LPs to help build trust.

Ryan Hoover suggests…GPT-3 written LP updates. (I think this is a joke, but I’ve recently become obsessed with a tool called Hyperwrite.ai, a self-proclaimed “writing companion” that’s worth a look for anyone who does long form writing).

Eric Bahn suggests... developing a caffeine addiction.