Personalize the pass

A primer on how to give every “no” as much care as every “yes.”

Halle and I were guests on Automate All The Things this week. Our intrepid host Aron Korenblit expertly spun up his own version of my workflow for alerting your colleagues that you want to go deeper on a company. As he did, I noticed something really important: He prioritized the “no” workflow.

In VC, we pay a lot of attention to the outliers. The business model is predicated on power laws, so the success stories and represent a vanishingly small percentage of the outcomes. Most investors ultimately say yes to about 1% of their pitches. But among founders, investor reputations are made on the long tail: the 99% who hear a no.

During our recent fireside chat, Vedika Jain from Weekend Fund explained why this was so powerful.

Vedika explained that a core part of Weekend Fund’s workflow is about “closing the loop with the person who introduced us [to a founder].” If they end up passing on a deal, they make sure to share the pass email with the person who introduced them to the founder to provide insight into the way that they think as investors.

This is a genius move. Not just because it helps to maintain and nurture relationships, but because, by sharing insight into the way that they think about potential investments, Vedika and Ryan are leveraging their network to make stronger introductions in the future.

Even when you don’t invest, founders (and the folks who introduce you to founders) value transparency and constructive, actionable feedback. When their founder friends ask them which VCs to prioritize, they’ll remember if you ghosted or sent a generic pass email riddled with cliches. How you deliver a pass will come back to you in the long run, for better or for worse.

Personalized passes don’t scale easily. I give a lot of pitch deck feedback and I love it — really! — but if I did it for every pitch I saw, I could spend dozens of hours every week going slide-by-slide and writing my thoughts in detail. If we committed to personalizing every pass from top to bottom and giving feedback on every single pitch, we’d never see the bottom of our inboxes.

To automate passes AND add a personal touch to every one, we have to make it supremely easy to focus on why we are passing on any given company. We also have to remove the cognitive burden of thinking about how we want to deliver that message.

And to protect our time, we have to know when we’ve said enough.

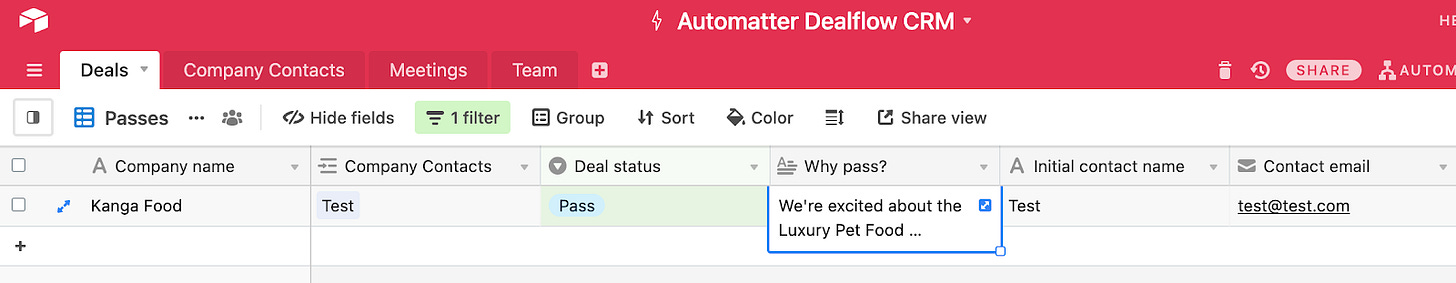

Here’s an example of how you might do this using our handy Automatter Dealflow CRM.

I replaced our old “Start DD” checkbox with a single-select field to indicate status and made a new view called “Passes” to filter in deals that we had decided to pass on. I also added a field called “Why pass?” where the investor can write about why we decided not to pursue the opportunity.

(If we were using this for real, we might add conditions that prevent users from changing the status to Pass before they’ve filled out “Why pass?” Because we’re going to trigger events as soon as the record enters this view, it’s best if all data in the record is finalized first.)

In addition to keeping this key information stored in a predictable and structured way, entering the pass reason directly into Airtable encourages brevity. If we were using Superhuman Snippets to write our pass emails directly into an email client, we’d be more likely to go on at some length. This process is designed to take that cognitive burden off our plates.

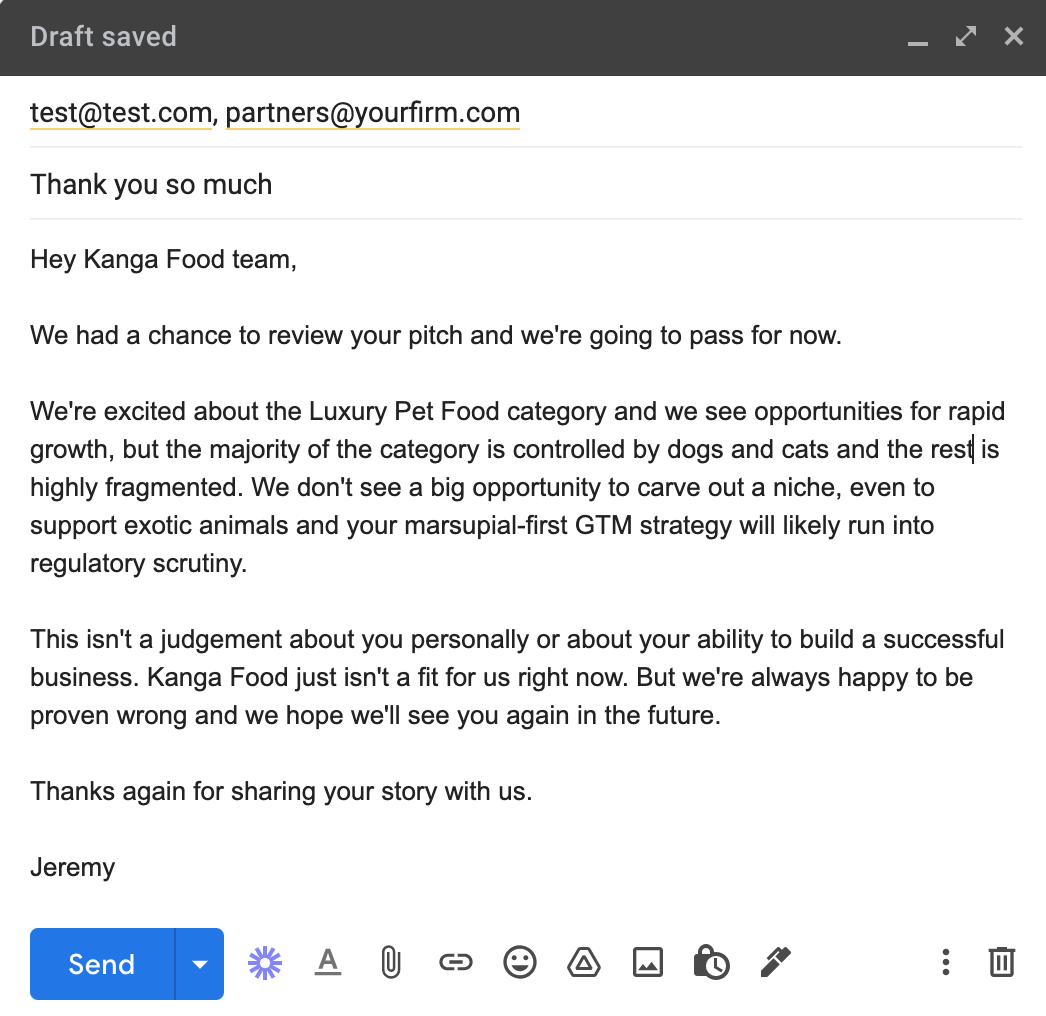

Instead, we’ll pipe that brief pass reason into a longer email template using Zapier.

I prefer to do this in Zapier because it allows you to create each pass email as a draft so you can layer on additional context and give it a last look before you send it out.

To make things even simpler, you can do this all in Airtable with a simple automation that sends the email as soon as it’s triggered. No draft step in between.

New investors and emerging managers learn something from every company they see. In every cold email, pitch deck, and founder meeting, they are honing their radars to spot the companies and founders they want to work with. That learning opportunity can go in both directions. By giving founders closure and actionable feedback, investors can simultaneously feed a healthy entrepreneurial ecosystem, develop their reputations, and build trust with founders over the long term.