Automating the Andreessen Analyst

How emerging fund managers can use automation to level the playing field.

The venture capital industry is exclusive and homogenous by design. According to research done by NVCA and Deloitte, just 3% of the VC workforce is Black and 4% Hispanic or Latino. While 45% of the VC industry is female, a much smaller percentage of women hold decision-making positions. And too many modern investors uphold this status quo through their continued reliance on warm introductions and pattern matching.

But diversifying an industry that was intentionally built on exclusion is not as easy as propping a door open and expecting folks from underrepresented groups to invite themselves in.

Emerging fund managers face a number of uphill battles, beginning with convincing LPs to give them money and companies to let them onto their cap table without an established track record. In a recent survey conducted by Silicon Valley Bank, a third of family offices -- historically the anchors of small funds and emerging managers -- said they had no interest in backing first-time GPs. First time managers from non-traditional backgrounds (read: didn’t go to Stanford or Harvard) are less likely to have access to high net worth individuals or family offices (which represent 70% of capital in Fund 1’s).

Beyond these external biases and challenges, emerging fund managers are resource and time constrained. Emerging managers are often raising and running their first funds on their own or with limited, part-time help. They spend hours juggling the administrative back office work that goes into managing a fund. In contrast, established funds may have more analysts and associates than they do investing partners. Andreeseen Horowitz has more than 50 employees… on its operations team. Partners at big established firms don’t have to do fund admin alone. They can delegate that.

How can emerging managers compete? They have limited budgets even for key professional services. They can’t delegate. So they must automate. By leveraging process automation and data strategy, emerging managers can claw back their time and cognitive space and earn the returns they deserve for themselves and their LPs.

In this post, we’ll tell you how to automate the Andreessen Analyst.

Straight from the horse’s mouth (a.k.a. the job description) — here’s what a VC Analyst or Associate does at an established VC firm with dozens (or hundreds) of portfolio companies and hundreds of millions (or billions) of dollars under management.

“Analysts serve as our front line in contacting and evaluating entrepreneurs with the hope of generating proprietary investment opportunities”

(Translation: This is a sales job. You’re going to write a million emails and get comfortable in our CRM.)

Automate:

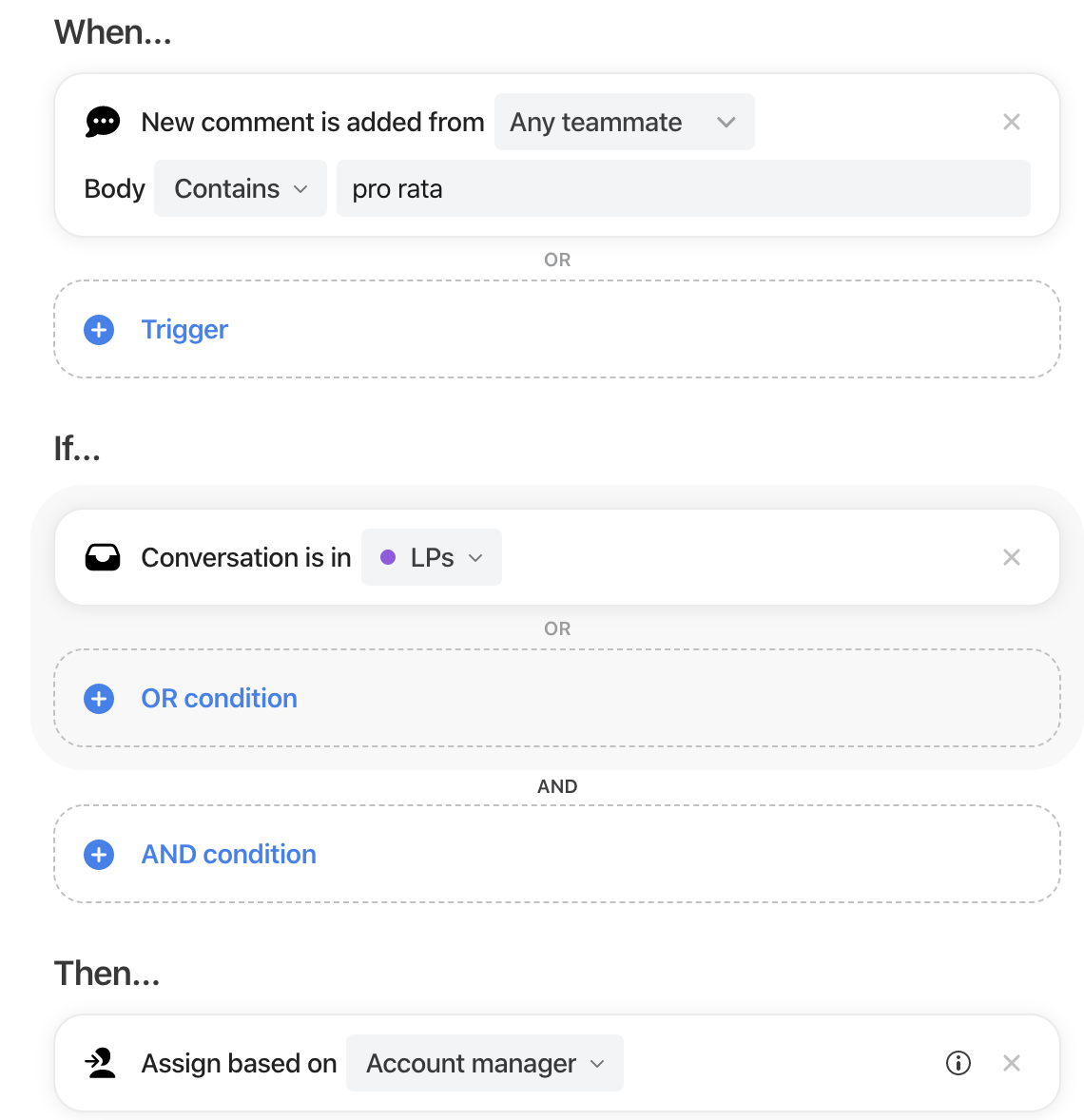

Use an email client or extension like Superhuman or MixMax to set up workflow rules and canned responses to manage both inbound and outbound deal flow. If you work with a team — even a small one — upgrade to a tool like Front App or Hiver that has shared inbox functionality, which lowers the switching costs for async collaboration.

Use a Twitter plugin like Flock to scrape meaningful updates from your Twitter network. Don’t you want to be the first one to know when one of your acquaintances adds “building something new” to their bio?

“Build and continuously update a set of companies to meet based on quantitative signals, market theses, and a network of key relationships”

(Translation: You gotta give us a heads up when there’s momentum forming around something! Or someone!)

“Monitor financial/operational conditions and industry dynamics of assigned portfolio companies”

(Translation: You’d better warn us before something dramatic happens!)

Automate:

Using the Airtable template included in our second post, get “as much data as possible into a digestible format” into a CRM.

Use a web scraper like Apify along with Zapier to alert yourself or your team when news is published about a specific company or market trend. Send these alerts to a dedicated sourcing channel in Slack.

When a company of interest is flagged in said Slack channel, use a specific emoji (for example, conga_party_parrot) to indicate that it should be added to a “New Deals” base in Airtable (which you can do with Zapier).

“Specific tasks will include capturing notes during pitches”

(Translation: Welcome to VC, where we obsess over note-taking apps because partners don’t take notes.)

Automate:

In the enterprise SaaS space, there are quite a few tools marketed for call coaching that will transcribe, annotate, and pull metrics from video calls (Gong.io, Chorus.ai). But did people forget that Zoom will record and transcribe meetings at no additional cost? We recommend using the transcribe feature (with your participant’s permission, of course) and then Control-F’ing the transcription for key topics. You could also check out Headroom, a VC-backed company that uses AI to transcribe, summarize, and highlight video meetings.

“Assist in the preparation of fundraising documents, investment memos, and investor updates”

(Translation: You’d better learn all the keyboard shortcuts and formatting tricks in Excel, Word, and Powerpoint because Clippy can’t help you now.)

Automate:

We’re gonna leave you with a cliffhanger here, since this is a topic we’re excited to discuss at length in a future post. To tide you over until then, check out Chris Harvey’s piece on legal document automation for venture.

“Ensure effective, timely communication with founders, investors and other stakeholders"

(Translation: Follow up. Follow up. Follow up.)

Automate:

Take advantage of features in the communication tools you’re already using. Any half-decent email client (like those mentioned above) will offer a snooze / nudge function to resurface emails at a later time.

Take it a step further by utilizing sequenced emails. If you’re doing outbound deal sourcing, set up an automated follow up email to go out if you don’t get an initial response. Obviously, use your judgement here - no one wants to be spammed with impersonal bullshit.

To be very clear, we believe that the onus is on established institutional investors to interrogate, challenge, and dismantle the structural barriers that have long benefitted them. But while we wait with bated breath for that to happen, we hope you find value in the recommendations we’re providing at Automatter. At the very least, we hope our tips give you some time back to attend a Peloton 90’s Hip Hop Ride.

Another resource to optimize on the 'venture tech stack' is 'Building a Venture Ecosystem' by GoingVC. See https://bit.ly/30f8BV9