Automating Ecosystem Operations

Wherein I cite my fourth grade science class experiment

I've been thinking a lot about ecosystems recently. Maybe because it's become a buzzword in the tech world or maybe because being quarantined for 10 months and counting leaves one thinking a lot about connectedness.

Ecosystems have become increasingly relevant as society becomes more networked through social media and modern technology. Anyone with a computer or smartphone can access tools to create, maintain, grow, track, and visualize their personal or professional ecosystem. The concept of a CRM was born out of a desire to understand the ecosystem around a company -- and is now used to serve the same purpose for individuals in the context of the personal CRM.

Companies of 10 or even 5 years ago would have scoffed at the thought of allocating talent and resources to a function that didn’t directly contribute to their bottom line. But, over the past five years, organizations have begun to prioritize ecosystem-building activities through the addition of partnership or channel partnership roles. Research by Deloitte has shown that investors actually give a higher valuation to companies that they see as “network orchestrators” because they are able to multiply their value to customers without necessarily reaching into their own pockets.

So, what role does “ecosystem” play in the venture industry?

The most obvious manifestation is the platform function.

Cory Bolotsky, former Head of Platform at Underscore VC, defines platform as: "the set of strategic activities, services, and initiatives that a venture firm carries out, outside of direct investment activities, that source new investments and support portfolio companies."

Heather Hartnett, GP at Human Ventures, explains that a platform function is "how the firm helps you build the community and ecosystem around your idea.”

If providing added value to portfolio companies was once just a meme, over the past three years, platform services have become a non-negotiable (at least for firms over a certain size). As the venture industry has become more competitive, firms have the opportunity to differentiate by providing unique value add services. Having an effective platform function requires strategic relationships - through scouts to source deals, talent networks to hire from, vendors who offer discounts, and subject matter experts who will act as advisors to your portfolio companies.

This is not an easy task: each additional relationship has to be established, tracked, maintained, and properly leveraged. The ability to quickly identify strategic relationships within your ecosystem requires a data-at-your-fingertips approach - lest you find yourself spending 30+ minutes searching through your Rolodex every time a portfolio company needs a referral for their next hire.

What does this mean for emerging managers and solo GPs, who are typically resource constrained? As a VC, you know that there are folks within your ecosystem that can provide value to one another (and that, by connecting them, you'll be the recipient of their gratitude). But how do you operationalize strategic connectivity?

With the proper systems and processes in place, an emerging manager can turn their ecosystem into a productivity multiplier, rather than an operational burden. Enter: "Ecosystem Ops."

Ecosystem Ops, a term that appears to have been coined by Crossbeam, is defined as "the workflows and systems that enable you to quickly source and implement partnerships."

Crossbeam's Olivia Ramirez explains that an organization can optimize their Ecosystem Ops by investing in tools for scaling and streamlining workflows and training your sales team and enabling your partners.

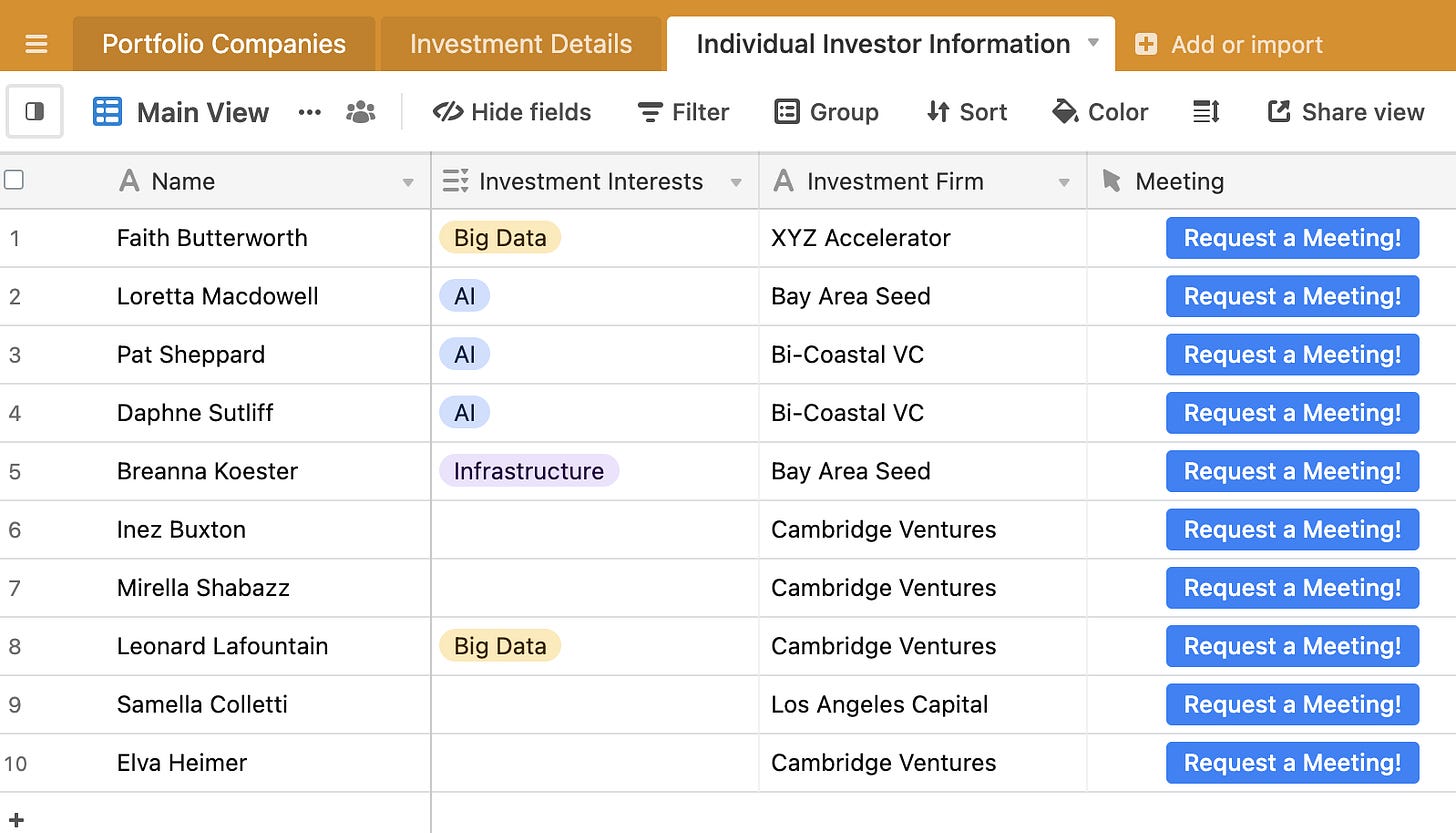

Automatter’s Emerging Manager Toolbox was built around tools meant to multiply productivity and decrease cognitive burden. At the forefront is a CRM, which we’ve discussed in depth in a previous post. Maintaining a well-organized CRM in a flexible tool like Airtable creates an opportunity to expose valuable data to specific external stakeholders in the form of a partner portal. For example, you could create an Airtable view for portfolio companies that exposes data on your LPs and other strategic advisors within your network, and allow founders to request meetings. You could give founders access to the advisor's scheduling link (I recommend Undock for this) using an Airtable button.

If you want to maintain more control over the process, add a generic "Request Meeting" button to the Airtable view which triggers a Slack or email alert (via Zapier) for you to approve the meeting request. Alternatively, if you're concerned about the privacy of your LPs and advisors, you could create an Airtable form for portfolio companies to request a meeting based on specific topics and from there make an introduction to the proper person. In fact, I made the form for you right here. Regardless of the specifics, this approach allows you, as the investor, to add value by brokering meetings without having to put in repeated leg work of making individual connections.

In venture, your portfolio companies, LPs, and strategic advisors are the foundation of your ecosystem. While I understand that there are often issues of confidentiality, it seems to me that GPs and syndicate leads don't typically do a great job of leveraging LPs as partners. Since LPs are typically high net worth, professionally successful, and well-connected individuals, this is a huge missed opportunity.

Paige Doherty, an angel investor and syndicate lead, recently posted a Twitter thread highlighting 15 of her LPs including their day jobs and areas of expertise. This is an unbelievable marketing tool to generate future deal flow.

In order to put your partners to work for you as an emerging manager, you need to provide them with some level of valuable data. At a minimum, this means giving them access to your pitch deck (or a version of it) and stats about portfolio performance. This is another fork in the road between operational burden and increased productivity. Writing regularly, in-depth, qualitative and quantitative LP updates is a huge time suck. Why not give LPs the benefit of data-at-their-fingertips as well? Tools like Visible and Paperstreet were built to reduce the burden and manual effort typically involved in investor updates. While both tools were originally built for portfolio companies to update their investors, they can easily be used by GPs to share specific portfolio metrics with LPs, providing them with data-at-their-fingertips and reducing the operational burden of ad hoc requests.

Building your ecosystem ops on top of flexible, API-first tools will set a foundation for success in an industry that is driven by networks and strategic relationships. The next generation of the emerging manager ecosystem will bring about higher levels of open source collaboration (or “coopetition”). It will become a competitive advantage to have data readily available in a format to share with strategic partners.

I have a vivid memory of the elementary school science class where I first learned about ecosystems. The teacher had us pair off and create our own ecosystems within plastic terrariums. It was a 9-year-old’s dream to spend a few hours getting our hands (literally) dirty. Our teacher explained that we had created what was called a “closed ecosystem,” a concept that very rarely exists in nature without some level human intervention. She explained that, while a powerful classroom experiment, closed ecosystems have their pitfalls. And so I’ll leave you with this food for thought:

I hope that VCs - both emerging and established - consider the dangers of contamination as they build and maintain their ecosystems.