The less you own, the less owns you

Building a lean tech stack to avoid the perils task switching and information silos

As I've immersed myself in the world of automation, process design, and no code, I have fallen in and out of love with every new tool I see on Twitter or Product Hunt. They strategically market themselves, teasing me with all the hours they’ll save and showing off the smoothest integrations you’ve ever seen.

As the no code ecosystem matures, the long tail of specialized tools will grow. We already see tools to connect APIs together, to transform your data, and to turn spreadsheets into apps; and vertical-specific offerings like Alloy and Hightouch for ecommerce. Specialization is compelling — why wouldn't you want a tool that was built especially for your very specific use case? Won't it do the best job? And they’re so cheap, you can expense any of these products and nobody will bat an eye.

But now I’m overwhelmed. Buried in "We miss you!" emails from tools I registered for and then never found the time to learn or use. I hurriedly archive these emails without opening them, ashamed that I, someone who spends her time writing about automation technology, haven't found the time to experiment with every single tool on the market. I am riddled with anxiety and shame every time someone asks: "What is the best tool for... [task management, internal team communication, pipeline tracking, etc]." This, I know, is fucking ridiculous.

I’m working on it. In fact, I think I might actually have an answer (drumroll, please).

The best tool to achieve any task, or execute any workflow, is the one that you are going to stick with.

Tool proliferation leads to increased complexity and increased complexity leads to productivity paralysis. Sure, you can save 15 seconds for every meeting you schedule, email you send, or item you add to your cart... but at what cost?

While pervasive marketing and a culture obsessed with productivity makes it easy to see the upsides of workflow automation tools, too often we fail to consider the repercussions of each tool we add to our tech stack. Those repercussions fall into three main buckets: 1) context switching 2) information silos and 3) systems of record.

Context Switching

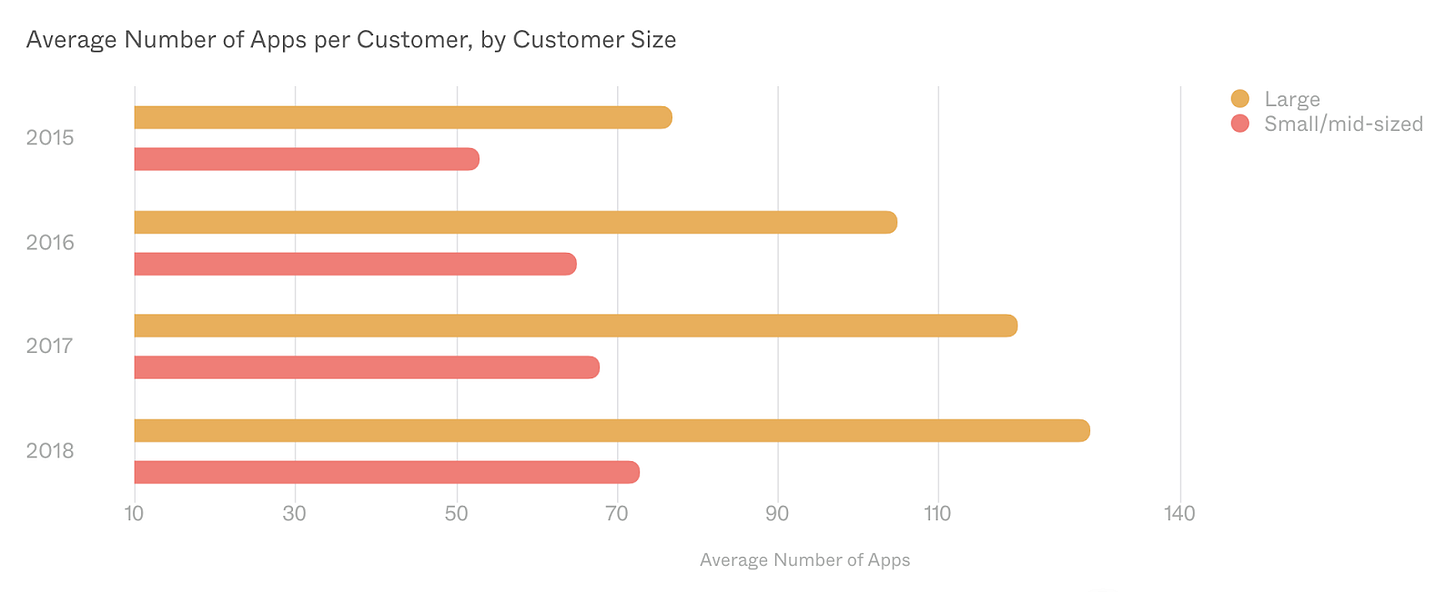

Multitasking is a myth. There have been some bold claims that multitasking costs the economy $450 million per year. But its cousin context switching — the experience of jumping between tasks, tools, or projects — is growing in line with the growth of available knowledge work tools. In 2018, Okta found that employees of large companies interacted with an average of 129 different business apps - up almost 70% from 2015.

There are costs, both tangible and intangible, associated with every tool a company adds to its tech stack. On top of the cold hard cash, there is the time spent implementing and integrating, decommissioning old systems, training users, and managing the operational changes necessitated by new systems. Intangible repercussions include the burden of metawork, or "the friction surrounding our tools and created by the combination of them and our organizations.” The anticipated productivity gains of each shiny new tool are often outweighed by the noise they create — the notifications, the tabbing between tools, the time spent trying to remember if that super important conversation you had with your boss happened in Slack, Notion, Superhuman, Zoom, Asana or… maybe it never happened at all?

As we continue to adjust to remote work, it’s increasingly important to resist the seduction of every new workflow tool on the market. Nine times out of ten, fewer tools is better.

Information Silos

The more tools in a given tech stack, the more places you are generating and storing information — and the more likely you are to create information silos.

In other words, it’s a system which collects or holds data, but does not allow for the exchange of data into or out of other systems. As I discussed in a previous post, I am wary of the insularity of many data tools, specifically those that have been built for the venture industry. This is one of the [many] reasons why I stan API first tools — because they are built on the foundational principle that they should be able to interact with data generated elsewhere. As remote work becomes the norm, we are generating a huge amount of data within the systems we use to do our work. This data has the potential to be a competitive advantage, driving us to work smarter rather than harder and better understand our customers. Or, it can create confusion, distress and cognitive burden.

Slack, which started as a casual messaging tool, has become the digital nervous system of the modern remote-first world. Business processes are defined, discussed, and documented in Slack — often unintentionally. What may seem like a casual exchange between colleagues may end up shaping a core business process, but most orgs don't have a mechanism in place to formalize these exchanges. If it’s a digital nervous system, it is disconnected from the body by default.

It's exciting to see some companies identify and solve for this challenge. Michael Rouveure, Head of No-Code Ops at Earnest Capital, just published a fantastic blog post detailing the Slack thread archiver he built to export value exchanges into a company wiki.

Systems of Record

It is common in both venture and tech to have two separate systems of record — one for operational data and another for financial data.

Your pipeline lives in your CRM, where you diligently (I'm sure) record every touchpoint with a potential customer/LP/founder in order to track the likelihood that the deal will close. The deal closes (congrats!) and you mark the opportunity as won in your CRM... and never think about it again.

If you're a VC, your focus then shifts to getting wires in or out. The bank account is now your financial system of record. How do you marry data between the two systems? If you're a full time VC, your fund admin probably takes care of this manually. If you're an angel, you probably enter your investments manually into an Excel doc, Google sheet, or Airtable (if you're on the bleeding edge of innovation). At 5-10 investments per year and zero LPs, this is probably fine. As someone on Twitter pointed out, "they're [all] just write offs anyway." But as your portfolio grows, you’ll inevitably forget to enter an investment into your spreadsheet or misrecord the terms. You’ll forget to follow up with founders and update valuations when the company raises subsequent rounds.

Luckily, VC Twitter is on it:

Arch Labs, a digital admin solution for private investments, is building a solution for individuals that aims to "automate operational investment tasks.”

Visible VC, a portfolio management solution whose praises I've sung many times before, expects to have a product for angels out by the end of the year.

For the DIYers, Fintable.io uses Plaid to integrate your banking data with Airtable. If you use a separate bank account to make investments, you can sync your investments with your Airtable CRM.

Seamless integrations are always preferable, but data silos can be broken down with intentional process design. This means that, if you do choose to stick with a spreadsheet, systematize the steps you take for each investment. It can be as simple as a checklist triggered by a deal closing in your CRM. It doesn't have to be complicated or fancy; you just have to stick to it.