Automating Capital Calls

Calm Fund creates leverage by using invoicing software to call capital

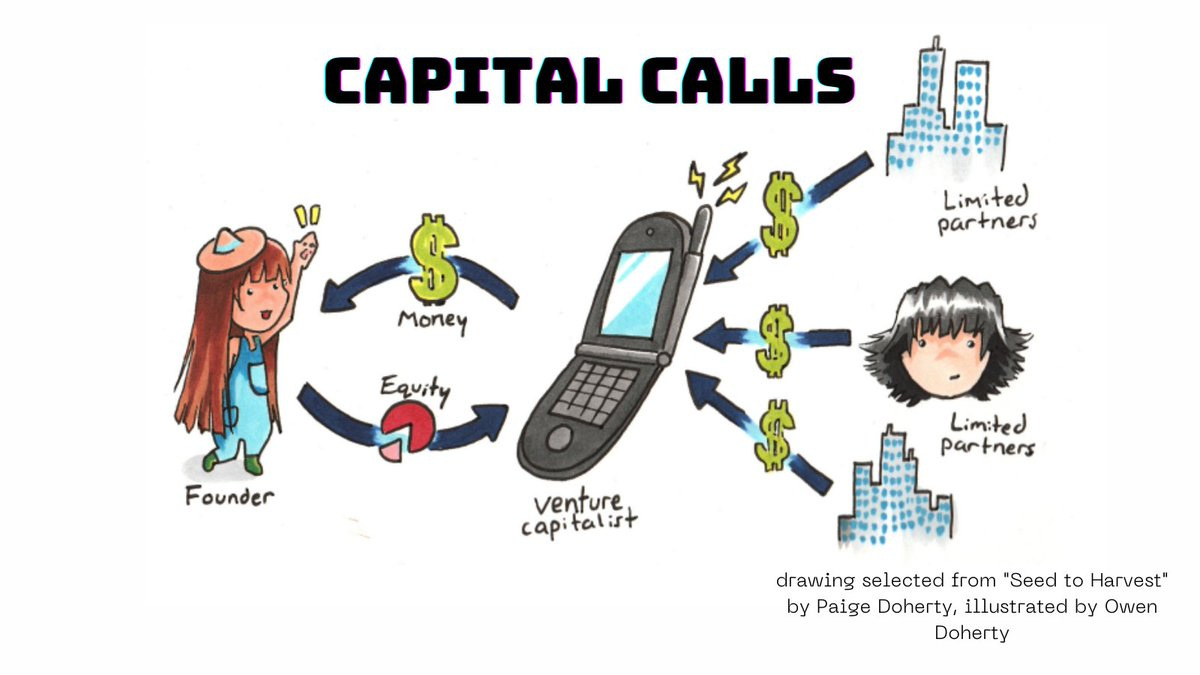

Over the past few years, venture capital has become increasingly demystified as industry veterans and new students share expertise online through formats like Twitter and Substack. One seemingly mundane topic of conversation that’s received quite a bit of attention are capital calls. Folks want to know exactly how, when, and why VCs actually take in cash (and subsequently wire it out).

In one of her famous tweetstorms, VC Elizabeth Yin explains:

“1) When you hear that a VC has raised $15m, the biggest misnomer is that you think their investors have actually wired them $15m.”

She goes on to unpack the concept of capital calls, a process by which funds which have previously committed (via legal agreement) are actually transferred to a fund’s bank account. As she explains, this typically doesn’t happen all at once. An investor who commits $1 million to a fund may not actually transfer the full amount for several months or even years. Funds are transferred between parties in predetermined chunks, at predetermined intervals, during what are referred to as capital calls.

Like many nuances of VC, capital calls have the potential to be a powerful tool but often become a significant burden. Capital calls can be especially valuable for emerging fund managers because they allow them to close faster without requiring millions of dollars in cash on hand. Capital calls can also be used strategically to accept check sizes below a fund’s minimum. And, as Paige Doherty of Behind Genius Ventures points out, capital calls can also be a powerful tool for new LPs because it allows them to fund their commitment over time to preserve more liquidity.

Unfortunately, the process of calling capital from LPs is (like so much of venture capital) traditionally manual and slow. Because of this, many fund admin and SPV providers limit the number of capital calls per investment vehicle. So I was very interested when I came across a thread from Tyler Tringas of Calm Fund about how his team has automated the process of calling capital from LPs.

I’ve long been a fan of Calm Fund because of their focus on creating leverage through automation. Calm Fund actually has a “Director of No-Code” who is responsible for building the tools and systems that support their fund, their LPs, and their portfolio companies. Calm Fund has always done things differently; they are a venture capital fund that was built for bootstrappers. Traditional VC means betting on a ton of companies, expecting 80% of them to fail and a couple of them to return the entire fund. As Tyler notes, this approach is “completely out of sync with the way most founders want to build a business.”

“Unless your business is in alignment with the venture model of investing in many failures to find a small handful of absurdly successful mega-winners, this path is not for you.”

Last year, Tyler and his team set up a quarterly subscription structure that leverages an incredibly well-thought out tech stack to automate the process of calling capital from LPs four times a year.

I had the chance to ask Tyler some hows, whys, and whats regarding Calm Fund’s automated capital calls:

Halle: What was your original motivation for offering quarterly commitments to LPs?

Tyler: Some good general advice for fundraising at the earliest phases (for funds or companies) is “seek out and find your true believers, don’t try to convert non-believers.” For us the early true believers were clearly individual successful software entrepreneurs who had built calm companies either to substantial profitability or exit. So we asked ourselves if we were really offering the right product to those “customers” as LPs with the traditional fund structure. It was pretty obvious that making a multi-year upfront commitment with arbitrary capital calls was not how individuals actually want to invest. The quarterly capital call structure makes investing in us work similarly to other investing: reasonable 1-year commitment length with fixed predictable capital calls every quarter. We wrote more about it here.

HKA: How did you evaluate and ultimately choose the tech stack you’re using to automate capital calls?

TT: My background is in SaaS so the idea was to bring the same toolkit to make capital calls as simple as SaaS. We work with an awesome fund administrator (Aduro Advisors) who manage the non-automated parts of the capital call process.

We use Stripe to process ACH payments. In theory this would also enable credit card payment but the fees are too high for it to make sense for a fund. We use invoiced.com to generate the capital calls as a kind of subscription product. It has a ton of features baked in like automate chasing of late payments, notifications, etc. The real magic is that once an LP using Invoiced + Stripe to ACH (I think Plaid is involved there too), their payment details are saved. So paying the next capital call is two clicks to approve and can also be set up to auto-pay.

Since ACH is only available to US-based accounts you do have to have fallback support for wires too.

For onboarding new LPs for the first time we use airtable heavily to qualify potential LPs and gather relevant information. We use a product called Anduin to manage the subscription agreement signing process.

HKA: What feedback (positive and negative, if any) have you gotten from LPs about this offering?

TT: They absolutely love it. There is a tiny bit of an education process for those that are active LPs in more traditional fund structures, but once they understand it they love it unequivocally.

HKA: How has offering quarterly commitments and automating capital calls furthered your mission of supporting bootstrappers?

I think being able to raise capital from up to 249 individuals has been hugely valuable for us. We have been able to push forward and prove out a pretty differentiated investment thesis without having to bring on more traditional LPs. Essentially it has allowed us to build this fund on our terms.

HKA: How does this compare to other flexible fund structures such as AngelList’s rolling fund?

TT: I think they are experiments trying to tackle the same core misalignment and make it easier for individuals to be LPs. We have a slightly different take than the rolling fund in that we do a new fund every year, rather than every quarter as AngelList does. The subscription agreement has the fixed quarterly capital calls but they just go into whatever 1-year fund is active at the time. This gives a little more diversification for LPs and less stress over missing the 1 quarter that has a huge break-out investment. It also allows us to be somewhat “backward compatible” with the traditional fund structure. It’s very easy for us to sign, for example, a 3-year subscription agreement with a large LP and offer collateralized carry across the 3 funds it would cover. This makes it looks exactly like a traditional fund structure from the perspective of a large LP while still allowing individuals to invest in the quarterly structure.

HKA: What are other ways that you’ve implemented automation / workflow software to create leverage for yourself as a solo GP?

Too many to name here. At any given moment we’ve got 400-500 Zaps running in Zapier and a full-time Head of No-Code Engineering adding more. Our interactive application form was also built entirely in no-code and has tons of automations built in to help me process dealflow efficiently.

Our capital calls go out on 1 Oct and I literally just got this reply from an LP :)